Tailoring PPAs for America’s Leading Corporations

Apex crafts agreements for ESG-focused corporates to accelerate the fulfillment of their clean energy goals.

First it was Starbucks. Then Walmart and Smithfield followed suit. In short succession, the three corporations announced significant renewable energy purchases at Diamond Spring Wind.

Originated and developed by Apex, and recently acquired by ALLETE Clean Energy, the 303 MW Oklahoma project will bring each of these global food companies closer to their respective corporate sustainability goals when commercial operations begin in 2020.

Diamond Spring is one of several Apex-developed projects expected to sign renewable energy purchase agreements in 2019 with leading corporations.

When it comes to renewable energy commitments, these name brands—recognized in virtually every American household—are moving with urgency to translate words into action.

At Walmart, its purchase of 175 MW of wind energy over 15 years takes it another step closer to meeting its near-term goal of powering 50% of its operations with renewable energy by 2025, and further setting an example for its suppliers engaged in Project Gigaton.

For Starbucks, the benefits of working with Apex start before the Diamond Spring Wind project comes online, when its largest wind PPA transaction to date—50 MW of clean energy over 15 years—will begin contributing to its carbon mitigation targets. The Old Settler Wind facility, located in Texas and co-owned by Apex and Northleaf Capital Partners, will provide over 1.5 million RECs to create a bridge to help Starbucks reach its RE 100 goal until the turbines at Diamond Spring begin to spin.

Smithfield, whose slogan is “Good food. Responsibly.,” completes its first renewable energy purchase for 75 MW over 12 years, taking a significant stride toward its 25% reduction goal of U.S. greenhouse gas emissions by 2025. To help reach that goal, the company created Smithfield Renewables, a platform that unifies and accelerates its carbon reduction and renewable energy efforts.

We are just getting started.

Diamond Spring is one of several Apex-developed projects expected to sign renewable energy agreements in 2019 with leading corporations.

Benefiting from one of the industry’s deepest and most diverse pipelines of utility-scale wind and solar projects under development—and the ability to negotiate highly customized renewable power purchase agreements to meet the precise needs of corporate offtakers—Apex is in a strong position to capitalize on the fast-growing ESG movement to decarbonize corporate and industrial operations, and therefore, the U.S. electric grid.

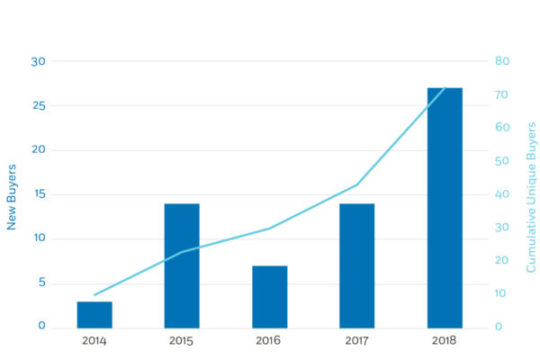

Corporate renewable procurement has surged in recent years, and the number of Fortune 500 corporations with 100% goals more than doubled from 2017 to 2018. But the movement doesn’t stop here.

On the heels of the 2018 elections, policy directives intended to decarbonize state-level economies are also on the rise. Overall, more than half of all U.S. states have implemented renewable portfolio standards, and meeting those needs will require an approximately 50% increase in renewable generation in the next decade.

Likewise, utilities are increasingly working to maintain control of their own destinies by seeking carbon solutions. In December, Xcel Energy became the first major utility to announce an aggressive commitment to 100% carbon-free electricity by 2050, taking one of many rapid steps toward meeting that goal through a 151 MW PPA executed with Apex at Dakota Range III in South Dakota, subsequently acquired by ENGIE North America. It was Xcel’s second transaction with Apex.

Our research proved that companies saw sustainability in terms of decarbonization and industry leadership—not just a renewable version of the business-as-usual commodity deal.

We knew it was coming.

In 2017, we rolled out a co-branded research report with GreenBiz in what was, at the time, the most in-depth study of corporate executives focusing on their perceptions of drivers of and barriers to renewable energy procurement.

The report succeeded in smashing the myth that companies were only moving to renewable energy because of falling prices. Instead, companies were making significant commitments to decarbonize and quickly discovering that the market was rapidly maturing and expanding. This trend provided unexpected options in terms of offtake, additionality, and financial participation that enabled each renewable energy purchaser to define its own value proposition and subsequently seek the best fit in the market.

We summed it up thusly: the research proved that the market saw sustainability in terms of decarbonization and industry leadership—not just a renewable version of the business-as-usual commodity deal that maximizes market timing.

Less than two years later, those options only continue to grow, through innovation and aggregation, creating unprecedented partnerships and significantly greater means to mitigate risk.

What’s next? Laser-like focus on measurement and reporting in ways relevant to and accessible by investors and consumers alike. And like every previous step of the way, Apex is gearing up to do what we can to help our partners realize their goals and maximize the moment.